Technical Analysis of Indian Stocks and Commodities

This blog is primarily to highlight stocks and the technical analysis charts which justify the call.

Saturday, April 26, 2008

Thursday, April 17, 2008

Wednesday, April 16, 2008

Tuesday, April 15, 2008

Monday, April 07, 2008

Sunday, April 06, 2008

Stocks with dandruff!

Some stocks which seem to display a Head and Shoulders Top pattern which is bearish by nature and can give pretty accurate targets if the pattern plays out.

Some stocks which seem to display a Head and Shoulders Top pattern which is bearish by nature and can give pretty accurate targets if the pattern plays out.Labels: Head and Shoulders pattern

Friday, April 04, 2008

Thursday, April 03, 2008

Wednesday, April 02, 2008

Tuesday, April 01, 2008

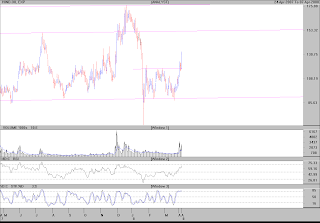

Bingo! ITC looks set to crack resistance

ITC ltd. is at a critical level in its recent uptrend and has been a market outperformer. The stock is at a critical level and a convincing close above 214 will give it room to go for the recent high of 236. Long positions can be taken with a stop loss which should be used considering the overall bearish market sentiment.