Technical Analysis of Indian Stocks and Commodities

This blog is primarily to highlight stocks and the technical analysis charts which justify the call.

Friday, October 27, 2006

Thursday, October 26, 2006

Monday, October 23, 2006

Saturday, October 21, 2006

Thursday, October 19, 2006

FourSoft swinging up to higher levels.

FourSoft (BSE code: 532521) is moving in a well defined rising channel. As the chart shows the scrip has broken out of a downward sloping resistance line and then after correcting for two sessions has swung up. CMP is 62.95 and long positions can be initiated with stop loss of 60 on closing basis. Targets are 69-70 and 78.

Tuesday, October 17, 2006

Monday, October 16, 2006

Saturday, October 14, 2006

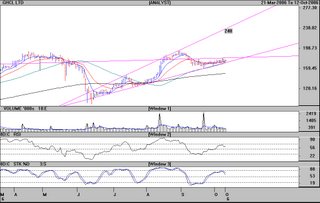

Hind Lever at throwaway price!

HLL or Lever in trader parlance is at 236 and has taken support at the lower end of a rising channel. Channel support is at 228. Long positions can be considered with a stop loss of 228 on closing basis. Upward targets ar 246 and 250 in the immediate term. 262-264 is important resistance and can be the next level to watch.

Thursday, October 12, 2006

Wednesday, October 11, 2006

Monday, October 09, 2006

LIC is a latecomer to the party!

LIC housing finance (BSE code:

500253) has been an underperformer to the overall markets. The stock has broken out of an inverted Head and Shoulders pattern and is consolidating. A move above 180 will bring a target of 205 in focus. A close below 169 will negate the trade and should be used to preserve capital.

Saturday, October 07, 2006

Sesa Goa awakens!

Sesa Goa (BSE code: 500295) has woken up refreshed from a ten week slumber. As the chart shows the scrip has broken out of the downward trending line on good volumes and is ready to test the "Scissor Trendline" at 1250. Closing above 1090 is important for this to happen. Stop loss should be 1010 on closing basis.