Technical Analysis of Indian Stocks and Commodities

This blog is primarily to highlight stocks and the technical analysis charts which justify the call.

Thursday, September 28, 2006

Wednesday, September 27, 2006

Monday, September 25, 2006

Friday, September 22, 2006

Monday, September 18, 2006

Sunday, September 17, 2006

Thursday, September 14, 2006

Wednesday, September 13, 2006

Tuesday, September 12, 2006

Sensex drops like the WTC!

Sensex has taken a huge fall on a typical "Black Monday" trade! The bearish candle has engulfed the past ten trading sessions, implying a lot of trapped bulls. For the uptrend to continue Sensex has to make a strong close above 12000 with good volumes. 11815 is resistance zone for any upmoves. 11500 is support as of now and any breach on closing basis will bring 11000 within range. As of now avoid longs and wait for trend confirmation.

Friday, September 08, 2006

Thursday, September 07, 2006

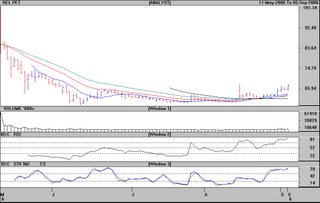

Arvind Mills spinning to higher levels

Arvind Mills closed outside a sideways channel (CMP 70) with reasonable volumes to make a case for bullishness. It has lagged the broader market and is making up while the indices correct. Fibonacci retracement tgts are marked on the graph for profit booking purposes. Stop loss at 66 on daily closing basis is an absolute must.